Explore web search results related to this domain and discover relevant information.

If the bank fails, you’ll get your money back. If you have over $250,000 in one bank, that amount is considered uninsured and experts recommend that you move the remainder to a different financial institution. A new report from the Federal Reserve finds that Silicon Valley Bank failed due ...

Recent bank failures may have you worried about your money. But there's no need for concern if your money is in a bank insured by the Federal Deposit Insurance Corp. and you have less than $250,000 there. If the bank fails, you’ll get your money back. If you have over $250,000 in one bank, that amount is considered uninsured and experts recommend that you move the remainder to a different financial institution.The Federal Reserve is scheduled Friday to release a highly-anticipated review of its supervision of Silicon Valley Bank, the go-to bank for venture capital firms and technology start-ups that failed spectacularly in March. (AP Photo/Jeff Chiu, File) Read More · Is my money safe?The Federal Reserve is scheduled Friday to release a highly-anticipated review of its supervision of Silicon Valley Bank, the go-to bank for venture capital firms and technology start-ups that failed spectacularly in March. (AP Photo/Jeff Chiu, File) ... NEW YORK (AP) — Recent turmoil in the banking industry may have you worried about your money.After Silicon Valley Bank and Signature Bank failed, regulators stepped in to guarantee all deposits at the two banks and created a program to help shield other banks from a run on deposits. ... Yes, if your money is in a U.S. bank insured by the Federal Deposit Insurance Corp.

Governments like fiat currency ... hits). They can increase or decrease the money supply at will, adjust interest rates, and pull off a host of other strategies intentionally restricted by the gold standard. Fiat currencies fail when they violate the basic characteristics ...

Governments like fiat currency because it gives them control of the economy (that is, until hyperinflation hits). They can increase or decrease the money supply at will, adjust interest rates, and pull off a host of other strategies intentionally restricted by the gold standard. Fiat currencies fail when they violate the basic characteristics of money.Weimar Germany, Hungary, Zimbabwe, and Yugoslavia now stand as infamous examples of fiat failure, but it is important to remember that these governments never intended to inflict such economic destruction. Policymakers genuinely thought money printing would solve their problems.Fiat currencies rule the world, despite their shoddy track record over the last 100 years. So why does fiat currency fail?The value of fiat money relies on public confidence: confidence that the government will manage the money supply responsibly, that inflation will remain under control, and that the currency will hold its purchasing power over time.

In a world that is changing quickly, ... to fail is not taking risks.” · Even if you are paid ₦10 million a year, it’s never enough to be financially independent. The most your “mouth-watering” salary can do for you is meet your basic needs and wants. Someone earning ₦1 million a year right now might think ₦10 million, is a lot of money until he/she ...

In a world that is changing quickly, the only strategy guaranteed to fail is not taking risks.” · Even if you are paid ₦10 million a year, it’s never enough to be financially independent. The most your “mouth-watering” salary can do for you is meet your basic needs and wants. Someone earning ₦1 million a year right now might think ₦10 million, is a lot of money until he/she begins to earn that sum and realizes it is not a lot.Money is a subject often avoided because it means facing certain truths people would rather not face. For example, These avoidances always have long-term consequences if not addressed on time. Here…I’m unaware of any successful person who didn’t take the risk. I’m not talking about success in terms of money alone, but there is a percentage of risk-taking in every other outlook on success.If you don’t invest that money in something that creates money, the ₦10 million will fizzle as soon as it gets into your account.

Chronic inflation is a fact of our age. Like the first of the plagues of Egypt, God has not spared His people from its ravages. But what does inflation mean for the future? What should Church members know - and do - about this economic ill? Few of us realize the kind of disruption, the social ...

Chronic inflation is a fact of our age. Like the first of the plagues of Egypt, God has not spared His people from its ravages. But what does inflation mean for the future? What should Church members know - and do - about this economic ill? Few of us realize the kind of disruption, the social breakdown, the Sodom and Gomorrah- like conditions that can happen during periods of hyperinflation.

Learn how to find unclaimed money from the government. Search official databases for money you may be owed by states, banks, the IRS, insurance, and more.

If a business, financial institution, or government owes you money that you did not collect, it is considered unclaimed money or property.You may be able to file for unclaimed money owed to you, or that was owed to a deceased relative if you are their legal heir.Most unclaimed money is held by state governments from sources such as bank accounts, insurance policies, or state agencies.Search for unclaimed money from your state’s unclaimed property office.

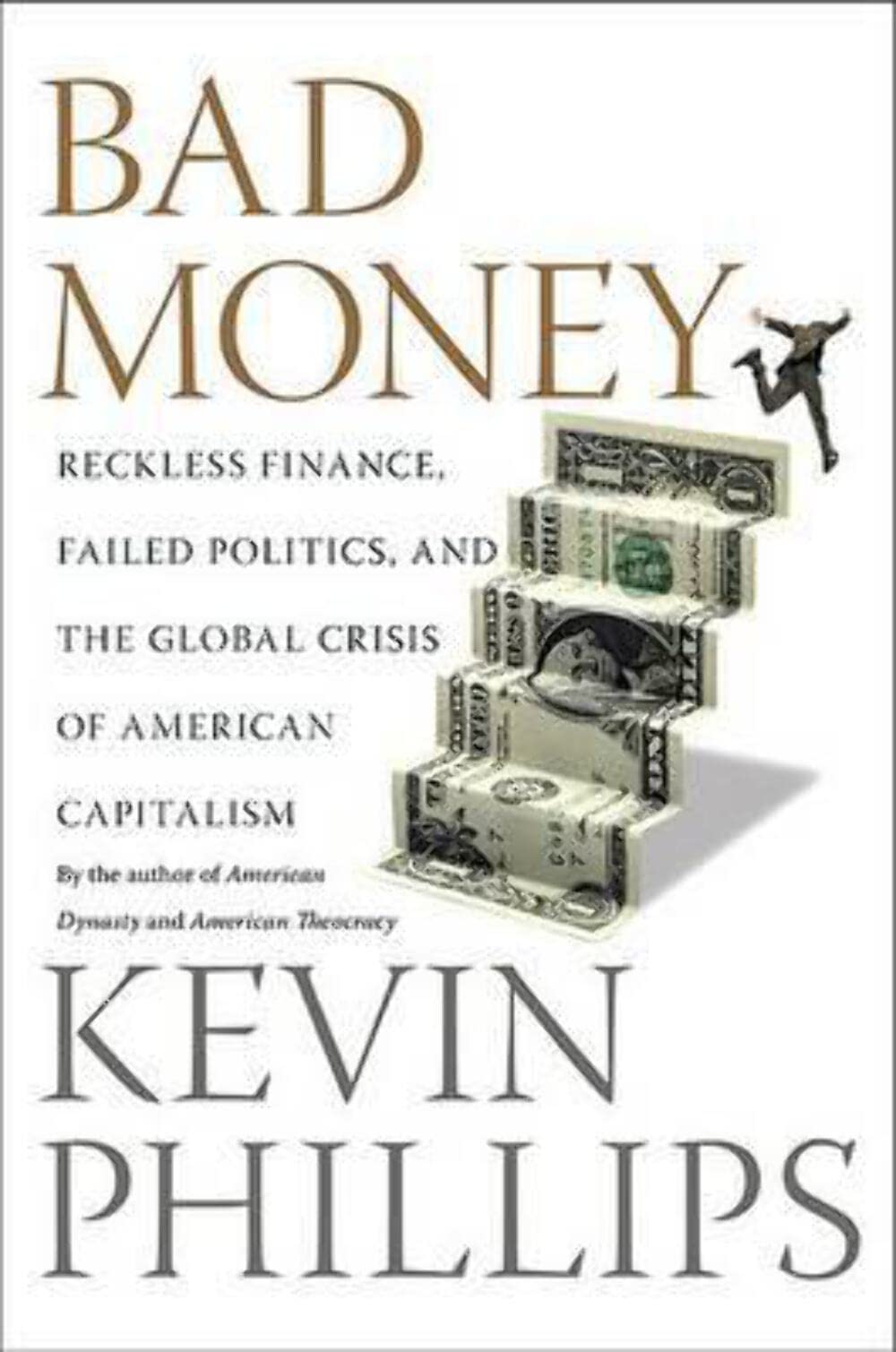

Bad Money: Reckless Finance, Failed Politics, and the Global Crisis of American Capitalism [Phillips, Kevin] on Amazon.com. *FREE* shipping on qualifying offers. Bad Money: Reckless Finance, Failed Politics, and the Global Crisis of American Capitalism

Kevin Phillips' latest book - Bad Money: Reckless Finance, Failed Politics, and the Global Crisis of American Capitalism - is not an easy read and not an easy book to review. To properly review it would take more space than is practical in this format.This item: Bad Money: Reckless Finance, Failed Politics, and the Global Crisis of American Capitalism"Kevin Phillips' latest book - Bad Money: Reckless Finance, Failed Politics, and the Global Crisis of American Capitalism - is not an easy read and..." Read moreIn his acclaimed book American Theocracy, Kevin Phillips warned of the perilous interaction of debt, financial recklessness, and the spiking cost (and growing scarcity) of oil- warnings that are proving to be frighteningly accurate. Now, in his most significant and timely book yet, Phillips takes the full measure of this crisis. They are a part of what he calls "bad money"- not just the depreciated dollar, but also the dangerous attitudes and the flawed products of wayward mega-finance.

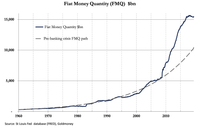

Listening to recent commentaries about the repo failures in New York leads one to suppose there is insufficient money in the system.

As the next credit crisis materialises, perceptions of investment risk are bound to change radically. The imperative to print money at an even faster rate will accompany the trend towards deeper negative interest rates, penalising bank deposits, eliminating residual savers from the system.FMQ is still $5 trillion above where it would have been today if the massive monetary expansion in the wake of the Lehman crisis had not happened. If there is a shortage of money, it is because the process of debt creation to fund current expenditure is spiralling out of control.This is not the real issue, as the chart below of the fiat money quantity for the dollar clearly shows.The fiat money quantity is the amount of fiat money (in this case US dollars) both in circulation and held in reserve on the central bank's balance sheet.

As you know from the previous chapter, the modern money has been created in a very different time when people had different worldviews and priorities than we have today. Throughout the history of our…

As you know from the previous chapter, the modern money has been created in a very different time when people had different worldviews and priorities than we have today. Throughout the history of our world, with all its wars, political reforms and revolutions, somehow the money system has been left unchanged.This begs the question, “Why don’t we review our money system?!” Somehow the subject remains largely untouched and it feels like a taboo to even talk about it. Modern economy is presented with numbers, equations and algorithms as if it’s science that is engraved in our nature, and nothing could be further from the truth.Although money has known different forms throughout history — from clay, metal to paper — it is merely represented as such. If you’re on a deserted island and you have a knife in one pocket and a dollar in the other, a knife will still be a knife but a dollar will be a useless piece of paper.Money in itself is worthless, it’s the products that are exchanged that have value. This value is then projected into the amount of money that is needed to transfer between accounts. It is also worth noting that only 3% to 5% of money exists in physical form.

And when money failed in the land of Egypt, and in the land of Canaan, all the Egyptians came unto Joseph, and said, Give us bread: for why should we die in thy presence? for the money faileth.

This is a reading plan on how to develop a healthy relationship with money. Money is a subject that most "good" people don't want to engage because it is associated with a lot of bad things. While others have used money for evil, most money is used for good. We interact with it everyday and yet few people take time to develop a healthy relationship with it.

Grant Cardone. 6,476,560 likes · 48,385 talking about this. • Private Equity Fund Manager & Real Estate Investor • $5B AUM • Cardone Ventures & Cardone Capital • Author, Husband, Father

Why Most People Fail at Making Money Online (and the Few Who Quietly Succeed) The hidden truths about online income and the system successful people follow The Harsh Reality: Most People Don’t Make …

But here’s the truth no one likes to admit: **the vast majority of people who try to make money online fail.** Not because they’re lazy, not because they’re not smart, but because they’re following the wrong playbook.The first reason people fail online is mindset. Most beginners come in with the idea that making money online should be fast, easy, and passive right from the start.If you’ve been trying to make money online without results, don’t beat yourself up. Most people fail in the beginning — it’s part of the process.The truth? Making money online *is possible*, but it’s not instant.

Learn how your deposits can be covered up to $250,000 per person per ownership category in the event your FDIC-insured bank fails.

Between 2001 and 2022, 561 banks failed, according to the FDIC. That may sound like a lot, but thousands of banks exist in the United States. The truth is, the likelihood of losing your money is extremely small as long as an FDIC-insured institution holds it.The FDIC is an independent agency of the United States government created in response to the thousands of bank failures that occurred during the Great Depression. The organization was created to restore confidence and stability in the economic system. One of the main ways it does this is by protecting the money people deposit in banks and savings associations.Nearly all banks in the United States are FDIC-insured, which means even if a bank were to fail, your money is protected. The FDIC insures each bank account up to $250,000 per depositor per ownership category, such as single owner or joint owner. If you use a credit union instead of a bank, you'll receive similar insurance coverage through the National Credit Union Association (NCUA).Insurance is one of the primary reasons it's a safer bet to keep your money in a bank account or credit union account than in other places. Importantly, however, the FDIC doesn't cover or insure investments like stocks, bonds, mutual funds, life insurance policies or annuities (even if these investments are bought at an insured bank). When a bank fails, the FDIC steps in to protect you by taking action in one of two ways:

Do you know the #1 reason small businesses fail? Cash flow. Learn how you can control your cash flow problems.

That’s the trick with a lot of budgeting – to continue to be careful with your money even when times are good. Actually, you have to save money and stay frugal when times are good.Very few business terms get as cool a response. And sadly, those two little words (both of them four-letter words, interestingly enough), are the #1 reason small businesses fail.82% of small businesses fail due to cash flow problems.

When we fail to set up an emergency fund, we’re more likely to withdraw funds from our retirement account, incurring penalties and losing compound growth, said Melinda Satterlee, the founder of Marathon Wealth Management in Medina, Wash. Too often clients don’t consider the downside of borrowing from a 401(k) plan. “They think, ‘This is money ...

When we fail to set up an emergency fund, we’re more likely to withdraw funds from our retirement account, incurring penalties and losing compound growth, said Melinda Satterlee, the founder of Marathon Wealth Management in Medina, Wash. Too often clients don’t consider the downside of borrowing from a 401(k) plan. “They think, ‘This is money I’m saving, I can access it,’ but they’re not told how much that will cost them,” she said.Even people with employer-sponsored retirement plans still find it difficult to save for the future when faced with present-day desires.If this sounds familiar, you’re not alone. Nearly 60 percent of those who are saving worry that they aren’t putting aside enough money for retirement, according to a 2024 Bankrate study. And in a 2024 AARP study, about one-quarter of U.S.Financial experts have identified five common habits that sabotage retirement savings, all stemming from our tendency to choose immediate gratification over future financial security. Here’s a closer look at these money missteps that can undermine long-term financial health — and practical strategies to overcome them.

Fiat currency, a system by which ... free to create money from thin air, reducing the value of the currency already in circulation. Fiat currency has reigned in the last forty years, but every fiat currency that has existed in history has eventually failed....

Fiat currency, a system by which a currency only retains its value by “fiat” or decree by a government, leaves a central bank free to create money from thin air, reducing the value of the currency already in circulation. Fiat currency has reigned in the last forty years, but every fiat currency that has existed in history has eventually failed.The Failure of Money originally appeared in the Daily Reckoning. The Daily Reckoning, published by Agora Financial provides over 400,000 global readers economic news, market analysis, and contrarian investment ideas.The two longest-surviving currencies are the British Pound and the US Dollar, both of which have lost the vast majority of their original value. The US is also deeply in debt, which encourages it to inflate its currency in order to reduce the dollar-value of that debt. Will the dollar beat the odds and survive? If it fails, what comes next?

Bought something you already regret? You’re not alone. Here are stories to help ease the embarrassment.

Talking about money, especially your most thoughtless purchase, can be embarrassing. However, you're not alone in those cringe-inducing money fails. Sometimes, the only way to do better is to learn from your mistakes and the mistakes of others. I asked my network about their money fails and what it taught them about making better spending choices.My biggest money fail was a money manifesting course by life coaches who had no idea what they were talking about. I felt so stupid for falling for what was basically a multi-level marketing scheme, and I lost money in the process.It was a huge fail. The woman leading the course was a streetwear designer turned life coach. I was seduced by the fact that she came from the design world and looked like she was making a lot of money on her terms.My money fail led me to do a Masters in Curation instead of Fine Art, so I could hopefully access better-paid work. I think being an artist is unrealistic for most people who don't have savings to fall back on.

UPI failed but money deducted? Get your money back using official RBI/NPCI process. Step-by-step recovery + compensation rights explained.

Contact NPCI directly if the bank or app fails. When you send money via UPI but the recipient doesn’t receive it while your account shows a deduction, it’s usually due to technical glitches, banking errors, or network issues.According to the RBI, if a transaction fails but the amount is debited from your account, the funds should be credited back to your account within 48 hours (T+1 day). Keep an eye on your bank statement for entries such as “UPI-REV” or “UPI-RET.” · Ensure your account details are correct to avoid delays. If the money is not reversed within the expected time frame:The RBI specifies the maximum time for reversal and compensation for delays in failed UPI or other digital transactions: ... Following this official process ensures your money is either refunded or credited correctly, and you are protected under RBI and NPCI regulations.API Gateway Failures: Communication breakdowns between different banking systems and UPI apps · Account Verification Delays: Time taken to verify recipient account details can cause transaction timeouts · Insufficient Balance at Destination: If recipient’s account has restrictions or is frozen, money gets stuck in transit

When Your Money Fails.. The 666 System is Here [Relfe, Mary Stewart] on Amazon.com. *FREE* shipping on qualifying offers. When Your Money Fails.. The 666 System is Here

“In my experience, those who fail to create and stick to a realistic budget are often surprised at how much small, unnecessary purchases add up over time.” · She noted that a lack of awareness about where money is going is the foundation of many financial setbacks.

From emotional spending to mismanaging credit, certain behaviors can sabotage even the most well-crafted financial plans.“Failing to build an emergency fund makes people vulnerable to debt,” Shahnazari said. “Without savings, my customers often resort to high-interest credit cards or predatory loans when unexpected expenses arise.If you’re trying to get your money on track, but still feel like you’re barely staying above water, it could be a sign that you’re holding onto some bad habits. Financial recovery often starts with a closer look at how you’re managing your money on a daily basis.Along the same line as the above, Shahnazari explained that not tracking daily expenses can lead to financial blindness. The first step in a budget recovery is assessing when, where and how much of your money is leaving your bank account each day, week and month.

Money is forever on our mind, and we often assume it will more or less be stable over the long run. But is this true? How can money fail? Perhaps it is failing us right now? We just don't see it.

With economic systems, there are at least two kinds of failure. Both are a variation of utility. (1) Utility as Functional When features within an economic system prevent or inhibit the ability of institutions and transactors from exchanging goods, borrowing money, lending money, or providing services, then one can say there is a functional failure.Having said that, such a failure does not mean it ceases to exist or ceases to be used. Economic behavior tends to follow the path of least resistance (in view of the goals one has). So barter would simply recede from the scene as a form of trade, but it might very well come back in certain instances—e.g. people want to avoid tax consequences and simply swap goods on the spot. Money Money can fail in sense (2) when a currency is devalued (and does not allow one to acquire what one might have had the currency not been devalued), prohibited (sanctioned), or not wanted (someone simply does not trust the currency as a store of value).There are other ways in which money can fail in sense (1), but as a way of closing, I’d just like to mention that the promise of blockchain technology and decentralized finance is to provide everyone with easier access to money. There are significant challenges, such as rectifying the need for over-collateralization.More interestingly (at least for me), money can fail in sense (1) when the flow and circulation of money is controlled in such a way that it favors a small percentage of the population.